Fresh Food Packaging Market Report: Materials, Applications, and Trends

The Fresh Food Packaging Market is experiencing robust demand as global food supply chains evolve to meet changing consumer preferences, sustainability mandates, and safety requirements. Fueled by rising consumption of fresh produce, dairy, meat, and convenience foods, this market is projected to witness significant expansion between 2025 and 2031.

According to recent industry estimates, the global fresh food packaging market was valued at approximately USD 91,803.36 million in 2024 and is expected to expand to around USD 143,700 million by 2031, reflecting a compound annual growth rate (CAGR) of 6.6% from 2025 to 2031. These projections indicate an accelerated adoption of innovative packaging solutions that preserve freshness and extend shelf life while supporting sustainability goals.

Market Size & Forecast

To put the growth into perspective:

- 2024 Market Size: ~USD 91.8 billion (Base Year)

- 2025 Estimated Value: ~USD 97.8 billion (projected using 6.6% CAGR)

- 2031 Forecast Value: ~USD 143.7 billion (projected using 6.6% CAGR)

This growth trajectory highlights an expanding opportunity for packaging manufacturers, suppliers, and brands that cater to fresh food segments such as fruits & vegetables, dairy products, meat, and seafood.

Key Drivers of Market Growth

The Fresh Food Packaging Market is being propelled by several macro and micro trends shaping the global food industry:

1. Shift Toward Fresh & Healthy Eating

Consumers are increasingly prioritizing fresh, nutritious food over processed alternatives, driving demand for packaging that maintains product integrity, hygiene, and shelf life. This translates into higher uptake of modified atmosphere packaging (MAP), vacuum packs, and resealable formats.

2. E-Commerce & Home Delivery Expansion

The growth of online grocery and meal delivery platforms has heightened the need for reliable packaging that protects perishable foods during transit, encouraging investments in robust packaging solutions.

3. Sustainability and Regulatory Pressure

Environmental concerns are pushing brands to adopt eco-friendly materials such as recyclable plastics, paperboard, and biopolymers. Major economies are introducing regulations to reduce plastic waste, influencing fresh food packaging innovation.

4. Technological Innovations

Smart packaging technologies—such as freshness indicators, RFID tracking, and active barrier solutions—are enhancing food safety and supply chain transparency, making packaging a value-added service rather than just a container.

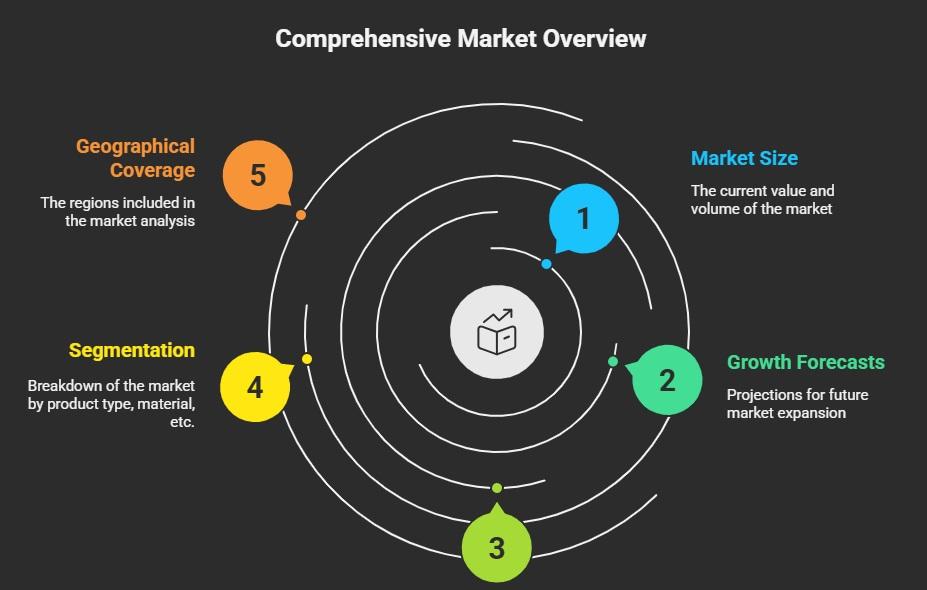

Segmentation Insights

The market landscape can be segmented across multiple dimensions:

By Material

- Plastic & Polymers: Still dominant due to lightweight and barrier properties.

- Paper & Paperboard: Gaining traction for recyclability.

- Metal & Glass: Used in niche fresh food scenarios.

Plastic accounts for over 40%+ of fresh food packaging material share in 2024 due to its versatility, even as sustainability trends boost alternatives.

By Packaging Type

- Rigid Packaging: Maintains structural integrity for fruits, vegetables, and dairy.

- Flexible Packaging: Preferred for convenience and extended shelf life.

Rigid solutions hold a substantial portion of current packaging formats, though flexible options are rapidly innovating with resealable and user-friendly designs.

By Application

- Fruits & Vegetables: Lead market share due to perishable nature.

- Dairy Products: Require specialized packaging for temperature and contamination control.

- Meat & Seafood: Growing demand for barrier and vacuum packaging to prevent spoilage.

Regional Landscape

Regionally, Asia-Pacific stands as the largest market, capturing significant share due to increased consumption of fresh foods and expansion of retail networks. Other regions like North America and Europe also contribute strong growth, driven by advanced supply chains and sustainability regulations.

Market Challenges & Opportunities

Challenges

- Material Costs: Volatility in raw materials, particularly plastics, can impact margins.

- Regulatory Constraints: Packaging regulations may force redesigns and higher compliance costs.

Opportunities

- Biodegradable and Compostable Materials: Growing consumer preference for green packaging.

- Smart & Active Packaging Solutions: Provide differentiation and improved food safety.

Strategic Imperatives for Businesses

For companies operating in the Fresh Food Packaging Market:

- Invest in R&D: Focus on sustainable materials and smart packaging technologies.

- Expand into E-Commerce Packaging Solutions: Align offerings with online grocery delivery needs.

- Enhance Supply Chain Resilience: Adopt flexible and resilient packaging to reduce waste and protect perishable foods.

Conclusion

The Fresh Food Packaging Market is on a high-growth trajectory, underpinned by consumer demand for freshness, regulatory shifts toward sustainability, and innovations in packaging technology. With a projected CAGR of 6.6% from 2025 to 2031 and robust market expansion from approximately USD 91.8 billion in 2024 to an estimated USD 143.7 billion in 2031, the sector presents compelling opportunities for investors, manufacturers, and brand owners ready to innovate and scale.